https://med.tu.ac.th/wp-content/uploads/2024/04/med.tu.ac.th-open-house-for-orthopaedic-residency-program-2025-open-house.jpg

1200

848

อรพรรณ บุญเรือง

http://www.med.tu.ac.th/wp-content/uploads/2020/03/Med_TU_Hr_Logo_Thai.png

อรพรรณ บุญเรือง2024-04-24 09:45:352024-04-24 09:47:01Open House For Orthopaedic Residency Program 2025

https://med.tu.ac.th/wp-content/uploads/2024/04/med.tu.ac.th-open-house-for-orthopaedic-residency-program-2025-open-house.jpg

1200

848

อรพรรณ บุญเรือง

http://www.med.tu.ac.th/wp-content/uploads/2020/03/Med_TU_Hr_Logo_Thai.png

อรพรรณ บุญเรือง2024-04-24 09:45:352024-04-24 09:47:01Open House For Orthopaedic Residency Program 2025แพทยศาสตรศึกษา

ประกอบไปด้วยองค์ความรู้ในศาสตร์ทางการแพทย์ ทั้งระดับแพทยศาสตรบัณฑิต แพทย์ประจำบ้าน แพทย์ประจำบ้านต่อยอด และบัณฑิตศึกษา รวมทั้งแพทย์แผนไทย เพื่อผลิตแพทย์และแพทย์เฉพาะด้าน ที่มีความรู้ความสามารถเพื่อช่วยเหลือประชาชนและสังคม

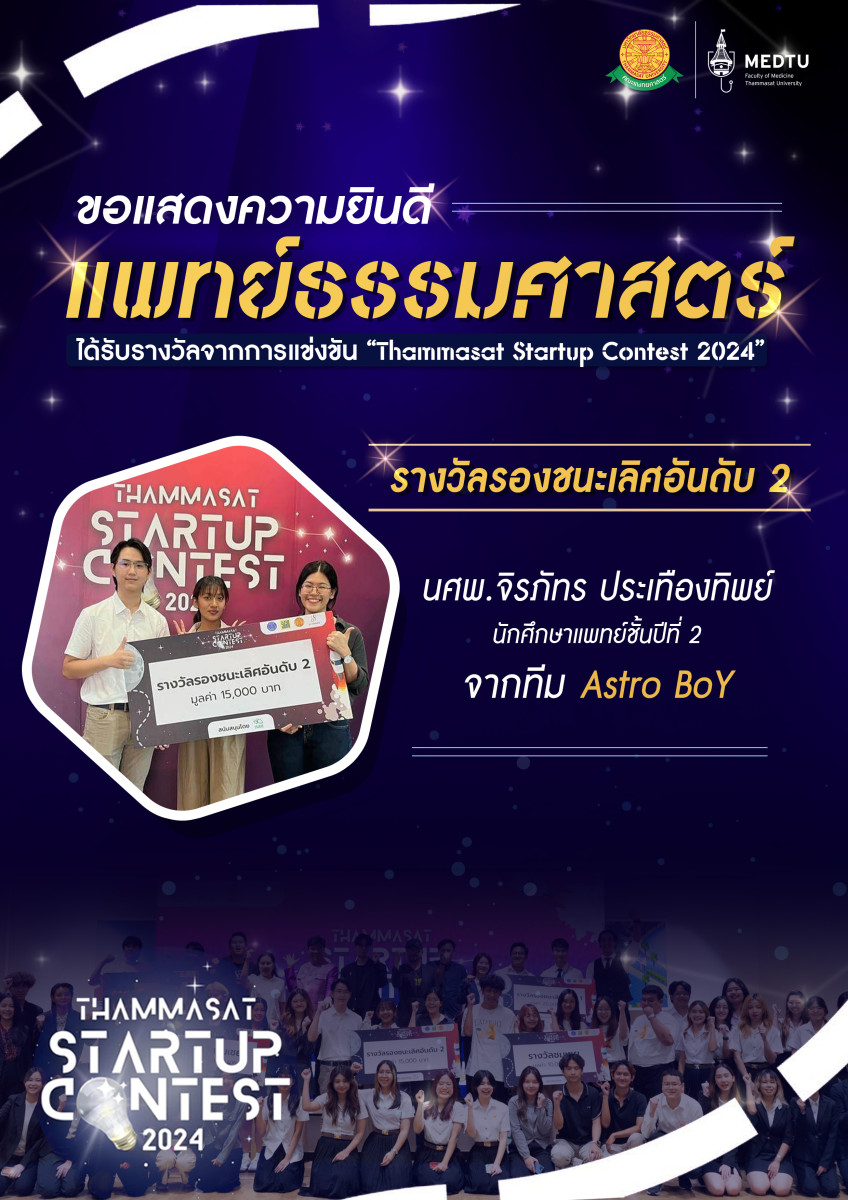

นักศึกษา

มุ่งเน้นการพัฒนานักศึกษาแพทย์นอกเหนือจากความรู้ความสามารถทางวิชาชีพแล้ว ยังสนับสนุนให้มีกิจกรรมเสริมหลักสูตรเพื่อเพิ่มพูนศักยภาพของนักศึกษา ให้เป็นผู้ที่มีคุณธรรมนำความรู้ สร้างเสริมสุขภาพให้แข็งแรง รวมทั้งผลักดันการพัฒนาตนเองของนักศึกษาเพื่อก้าวสู่สากล

วิจัย

สนับสนุนพัฒนานักวิจัยของคณะแพทยศาสตร์ให้ผลิตงานวิจัยที่มีคุณภาพและถูกต้องตามหลักจริยธรรม เพื่อให้ได้ผลงานวิจัยที่มีประโยชน์ต่อวงการแพทย์และสาธารณสุข ทั้งในระดับชาติและนานาชาติ

บริการสังคม

งานบริการสังคม จัดตั้งขึ้นเพื่อสำหรับการให้บริการทางวิชาการแก่สังคม ได้แก่ ด้านการแพทย์ วิทยาศาสตร์การแพทย์ และการแพทย์แผนไทยประยุกต์

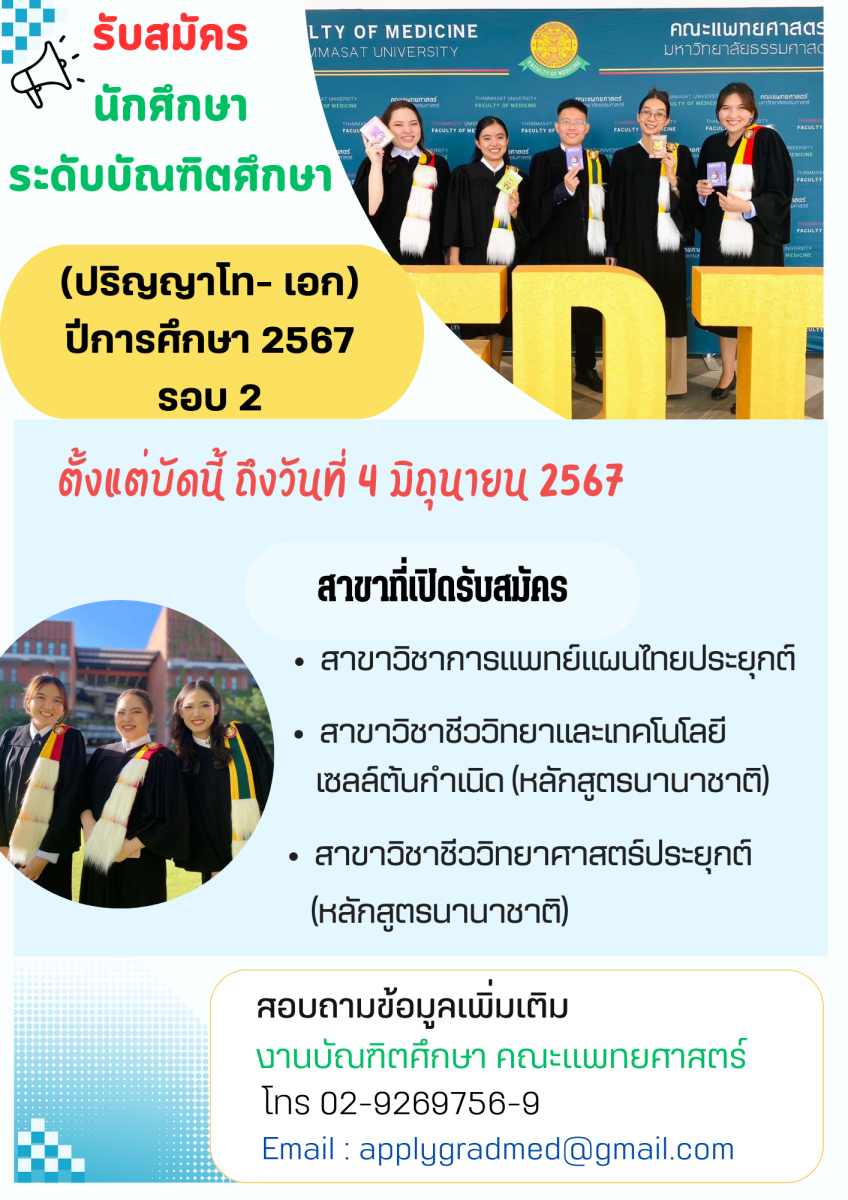

ประชาสัมพันธ์

ข่าวสาร และกิจกรรมต่างๆ ประกาศรับสมัครบุคลากรและการจัดซื้อจัดจ้าง รวมทั้งปฏิทินกิจกรรมสำคัญที่กำลังจะจัดขึ้น

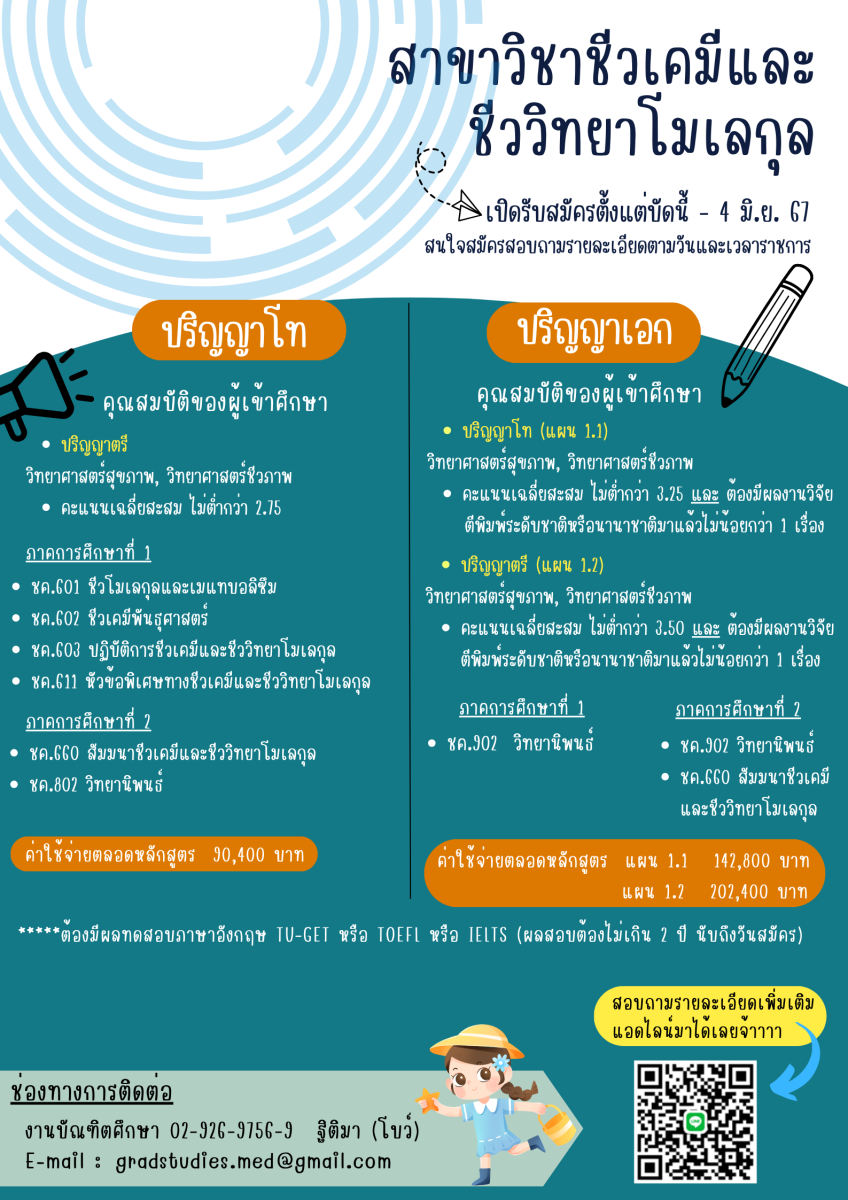

แพทยศาสตรศึกษา

ประกอบไปด้วยองค์ความรู้ในศาสตร์ทางการแพทย์ ทั้งระดับแพทยศาสตรบัณฑิต แพทย์ประจำบ้าน แพทย์ประจำบ้านต่อยอด และบัณฑิตศึกษา รวมทั้งแพทย์แผนไทย เพื่อผลิตแพทย์และแพทย์เฉพาะด้าน ที่มีความรู้ความสามารถเพื่อช่วยเหลือประชาชนและสังคม

นักศึกษา

มุ่งเน้นการพัฒนานักศึกษาแพทย์นอกเหนือจากความรู้ความสามารถทางวิชาชีพแล้ว ยังสนับสนุนให้มีกิจกรรมเสริมหลักสูตรเพื่อเพิ่มพูนศักยภาพของนักศึกษา ให้เป็นผู้ที่มีคุณธรรมนำความรู้ สร้างเสริมสุขภาพให้แข็งแรง รวมทั้งผลักดันการพัฒนาตนเองของนักศึกษาเพื่อก้าวสู่สากล

วิจัย

สนับสนุนพัฒนานักวิจัยของคณะแพทยศาสตร์ให้ผลิตงานวิจัยที่มีคุณภาพและถูกต้องตามหลักจริยธรรม เพื่อให้ได้ผลงานวิจัยที่มีประโยชน์ต่อวงการแพทย์และสาธารณสุข ทั้งในระดับชาติและนานาชาติ

บริการสังคม

งานบริการสังคม จัดตั้งขึ้นเพื่อสำหรับการให้บริการทางวิชาการแก่สังคม ได้แก่ ด้านการแพทย์ วิทยาศาสตร์การแพทย์ และการแพทย์แผนไทยประยุกต์

ประชาสัมพันธ์

ข่าวสาร และกิจกรรมต่างๆ ประกาศรับสมัครบุคลากรและการจัดซื้อจัดจ้าง รวมทั้งปฏิทินกิจกรรมสำคัญที่กำลังจะจัดขึ้น